#MTDVAT - Bridging App for Mobile / Desktop

( Recognised by HMRC, Works like Your Mobile Banking )• Confirming HMRC MTD VAT Return

• E-filing MTD VAT Return - Bridging

Simple and Easy to use, suitable for all Mobile phones / Devices / Desktop

Click on the button to download our MTD VAT (TEST) App using which you can test the HMRC MTDVAT sandbox instantly

MTD VAT means making tax digital for VAT and companies are obliged to file their VAT return through a new digital channel to HMRC . Officially, HMRC has never required any one to change their accounting package or spreadsheet to be in compliance.

What you need is a bridging system that capable of submit your VAT to HMRC through its digital channel as from April 2019. Mobile Tax Digital mean for Making Tax Digital efficiently CONFIRMING or E-FILING your MTD VAT returns.

MTDVAT app helps me to pin point the status of each and every VRN return, liabilities and payment due date at HMRC whenever I feel like it.

I can get up to minute info and act in good time by just turn on my mobile

It took me just a few minutes to download the apps from the Google Store known as MTDVAT - LIVE SERVICE. With a few more minute to set up the Grant Authorisation I have all this excellent services for FREE

On my way back to my office I tapped on MTDVAT app I was able to conclusively confirm directly from HMRC back end system that my colleagues have completed all our MTDVAT returns correctly. Now I can sit down with ease to plan my cash flow effectively and act in good time.

Thanks to MTDVAT App for providing such a convenient service over my mobile.

I can now answer any e-filed VAT return to HMRC query from anywhere. Not just me, you too can get the e-filed VAT data from HMRC back end in the same way you login to view your Mobile Banking transactions.

Thanks to MTDVAT app for making my life so much easier

MTDVAT.com stands for Mobile Tax Digital for VAT. It is an app for all VAT users

MTDVAT App is a MTD VAT bridging system provided by Mobile Tax Digital (www.MTDVAT.COM ) with the following functions for all to use it for Free

Confirming MTD VAT Return

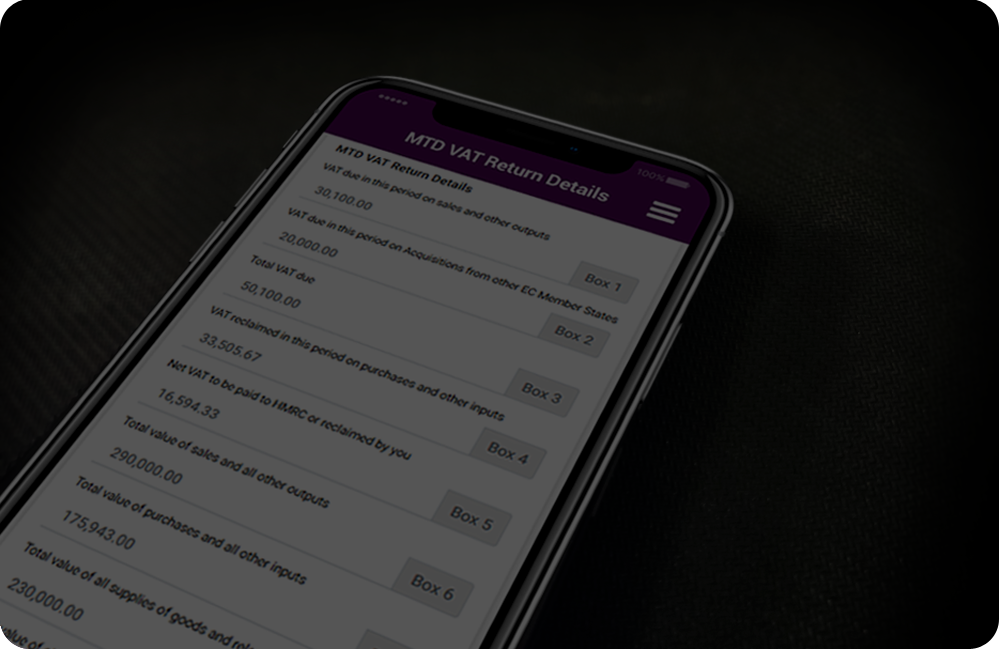

MTDVAT app link permanently to HMRC MTD VAT back end that can conveniently tell over your mobile phone what VAT you have e-filed to HMRC, what Liabilities and Payment you have in HMRC system. VAT operators, supervisor, Accountants, Auditors, from company or VAT agents can all use this app for confirming your VAT status with HMRC. It will work seamlessly with whatever accounting or spreadsheet VAT system you have. It guarantee the app will work for your system without fail.

E-Filing MTD VAT Return

You can e-file your VAT data with MTDVAT app singly or in batch. Unlike other bridging solution it save you from cut and paste the VAT data to a template. It takes in Sage and many others VAT file as given,. This will save you time with maximum accuracy and MTD VAT digital compliance assured.

MTD VAT News and Announcement

MTDVAT App also link to HMRC website provide you with the most up to date announcement and policy at the moment HMRC publish it at HMRC website. Take out your mobile phone it tells you all.

Other important MTD VAT news forum is on the way

If you are comfortable with your mobile banking you can entrust this MTDVAT app to performance the task you need for MTD VAT compliance. It adopts the identical technologies used by mobile banking industries.

When we say Free it means Free with no string attached or trap you into a particular accounting solution.

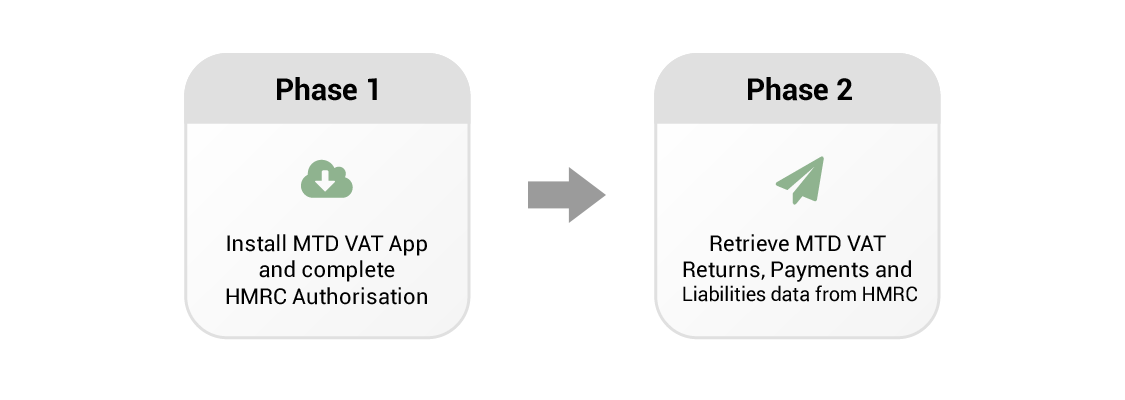

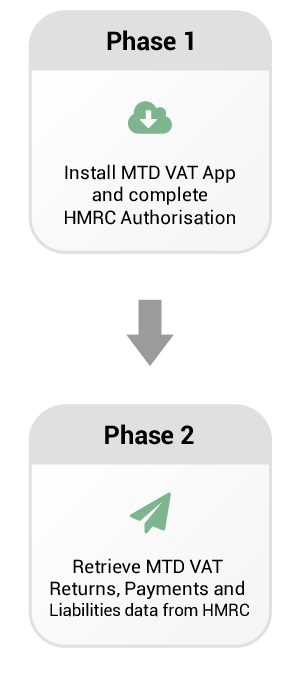

How does Confirming VAT Return work?

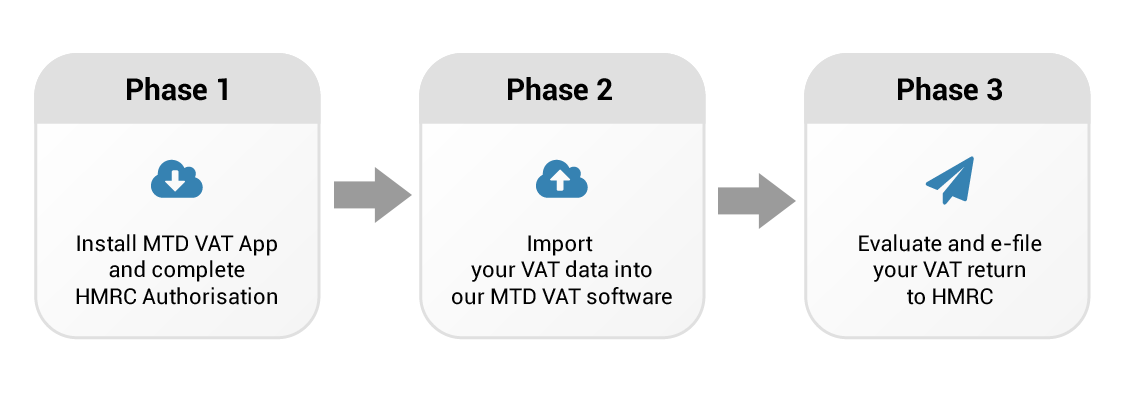

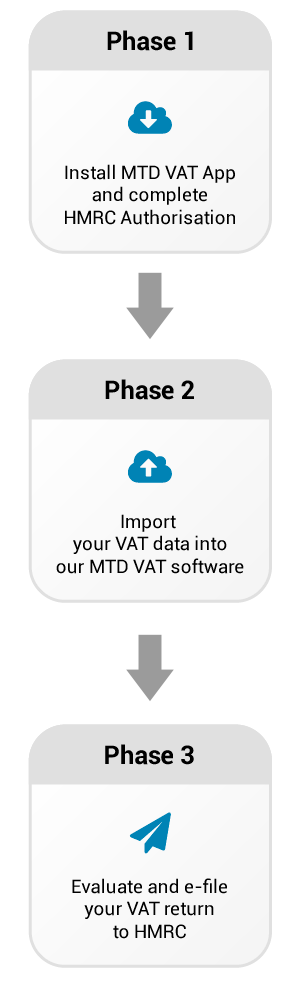

How does E-Filing MTD VAT Return - Bridging work?